Conclusion: Benlysta’s modest efficacy benefit is overwhelmed by its disadvantages in dosing and price, which explains why sales are well below pre-launch expectations.

Shortly before the approval of Benlysta (belimumab), Equinox Group evaluated the Systemic Lupis Ertheymatosus (SLE) market for a client company. Wall Street analysts and industry observers expected substantial commercial success for Benlysta, predicting revenue for the year 2020 from $700 million to $1.7 billion. Part of this enthusiasm was driven by the fact that belimumab is the first new drug approved for SLE in more than 50 years.

Our interviews with KOLs found widely divergent views regarding the appeal of belimumab; half of the interviewed KOLs were enthusiastic about it, and half were not. Our Clinical Innovation analysis at that time (based only on publicly available – and thus incomplete – data about the clinical attributes for belimumab) implied the antibody was not clinically innovative.

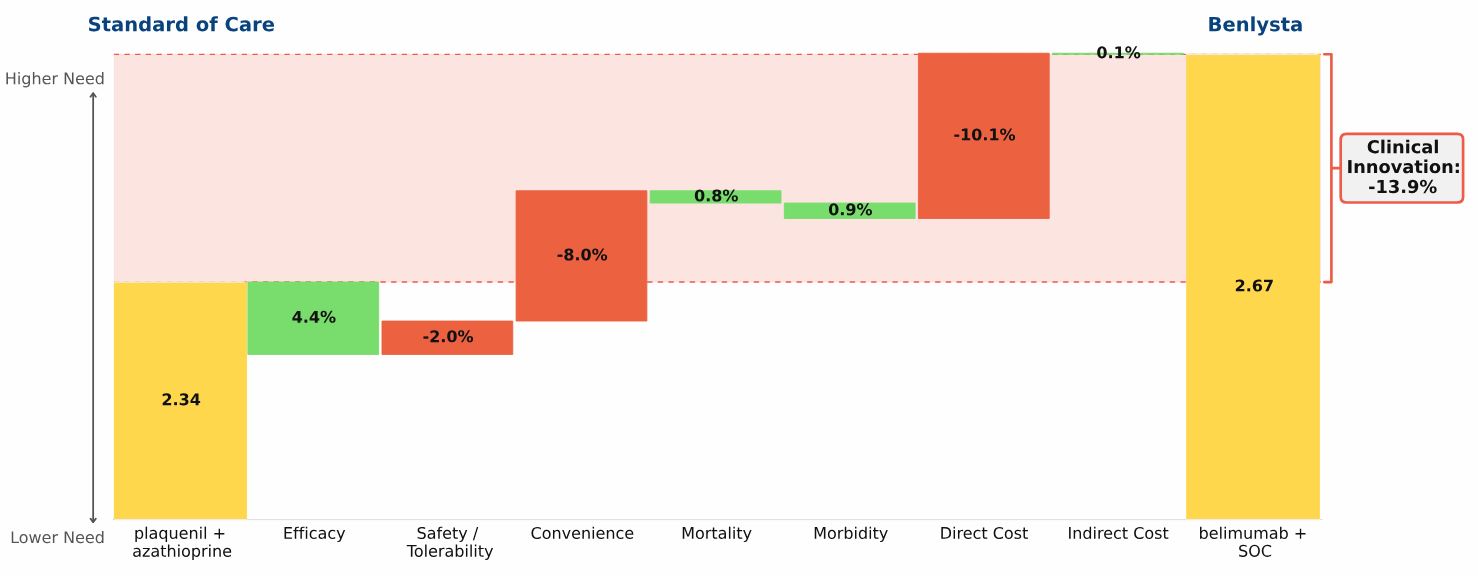

The “Drivers of Improvement” graphic below, which is based on complete published clinical results for belimumab, illustrates the comparison:

Plaquenil + azathioprine, representing the current standard of care (SOC), has a total unmet need score in SLE of 2.34, the yellow bar on the left side of the graphic

Belimumab is used in combination with the current SOC. The combination regimen has an unmet need score of 2.67, the yellow bar on the right side of the graphic

Adding belimumab to the SOC results in negative Clinical Innovation of 13.9%, compared with plaquenil + azathioprine alone

Our analysis quantifies the advantages and disadvantages of adding belimumab to the SOC:

Adding belimumab to the SOC results in a moderate improvement in efficacy

The increase in the safety/side effect burden is relatively modest

The inconvenience of belimumab’s IV infusion and its very high price overwhelm the modest efficacy gain

The FDA approved belimumab for SLE in March 2011. Wall Street’s billion-dollar expectations have not been met: in 2012 belimumab achieved $106 million in total sales, and for the first half of 2013 one brokerage firm has estimated $105 million. Because the net clinical improvement of belimumab is substantially negative, we think its peak-year sales in this indication are unlikely to exceed $300 million/year.

WHEN PRIMARY RESEARCH AND CLINICAL INNOVATION ANALYSIS POINT IN OPPOSITE DIRECTIONS

We do not know what GSK’s expectations were for belimumab in SLE. If, however, GSK conducted market research that supported the kind of revenue forecasts that outside analysts published at the time of belimumab’s launch, it would not be the first time a drug missed sales expectations set by pre-launch primary research. Given the results of our Clinical Innovation analysis, and upon learning the primary research supported a positive commercial outlook, we would have recommended conducting a careful review of the following aspects of that market research:

Was the magnitude of the efficacy and safety/side effects trade-off properly captured?

Was the IV dosing properly framed?

Was belimumab’s high price accurately reflected in the research with physicians and payers?

How was preference share converted to patient share?