Conclusion: Brintellix has “negative Clinical Innovation” relative to generic escitalopram, suggesting that Brintellix will struggle in major depressive disorders, and that sales are unlikely to reach the level predicted by the developers.

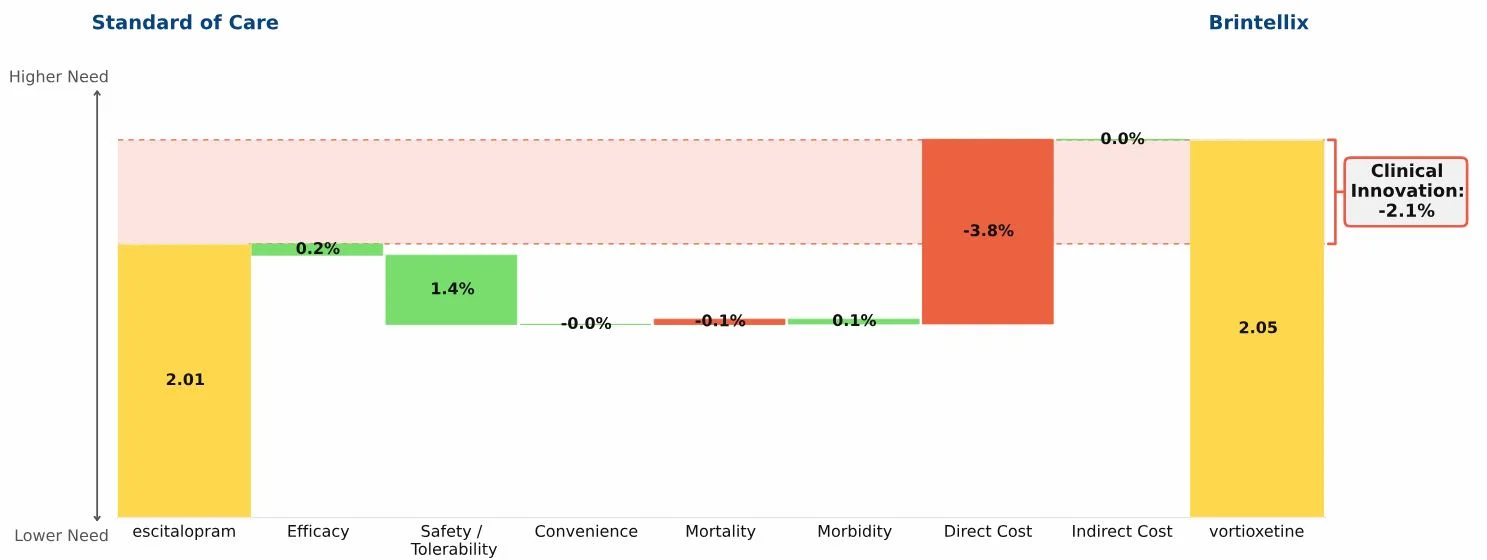

In September 2013 the FDA approved Brintellix (vortioxetine), a new antidepressant from Lundbeck and Takeda. Marketing authorization from the European Medicines Agency was granted in December 2013. The “Drivers of Improvement” waterfall graphic below summarizes the results of our analysis of Brintellix compared to generic escitalopram (the current standard of care):

Generic escitalopram’s total unmet medical need score in MDD is 2.01, shown in the yellow bar on the left side of the graphic

Brintellix’s unmet need score is 2.05

Brintellix’s Clinical Innovation, or percent reduction in medical need, is negative 2.1%, meaning it is at a net competitive disadvantage relative to generic escitalopram

The graphic shows the magnitude of the advantages and disadvantages of Brintellix compared to the escitalopram:

The combination of advantages in efficacy and safety/tolerability are modest (summing to 1.6%)

Those small advantages are overwhelmed by the negative impact of a much higher branded price for Brintellix compared to generic escitalopram, which gives Brintellix a 3.8% disadvantage in direct cost.

For some patients, the clinical differences may be significant, but we think payers will enforce restricted access to Brintellix, owing to its high price and relatively modest clinical benefits.

Fierce Biotech reported on January 6, 2014, that Lundbeck and Takeda estimate peak-year revenue for Brintellix of $2 billion, and Deutsche Bank has estimated peak sales at $1.85 billion. We at Equinox Group think these estimates are too high. By our established metrics, Brintellix is not clinically innovative – we think it will be perceived as a “me-too” product. The Equinox Share Predictor (which reflects the historical relationship between the Clinical Innovation offered by new drugs and the patient shares they achieve) estimates a patient share that would translate into peak revenue of about $1 billion.

The range of uncertainty in predicting patient shares is wide when Clinical Innovation is close to zero as in this instance. Factors such as promotional spend have a greater effect when there is little clinical differentiation. But in 2007 Pristiq launched in MDD with a 0%Clinical Innovations core against branded escitalopram, and it achieved peak year sales of about $650 million, providing further support for the view that Brintellix is unlikely to achieve $2 billion in peak-year sales.