PD-1 inhibitors are the newest class of immunotherapy drugs approved for cancer. They have a unique mechanism of action and debuted in the market for melanoma amid great promise. Like Avastin (bevacizumab) before them, PD-1 inhibitors have labels in multiple cancers and are in late-stage trials in many more. The data for Keytruda (pembrolizumab) and Opdivo (nivolumab) in both melanoma and non-small cell lung cancer (NSCLC) clearly demonstrate that PD-1 inhibitors represent a major advance in cancer therapy. Equinox Group will monitor this area and update our analyses as more clinical data becomes available. Below we focus on Opdivo in several tumor types.

Opdivo in non-small cell lung cancer (NSCLC):

Opdivo has a label for previously treated advanced squamous NSCLC where the standard of care (SOC) has been docetaxel. Opdivo has superior efficacy compared to docetaxel in all measures: median overall survival, median progression-free survival, overall response rate, as well as a better side effect profile. Docetaxel’s generic pricing is approximately $3,000 for a 2nd line NSCLC course of therapy, whereas Opdivo has a branded price of approximately $46,000 for a course of therapy in the same indication. Based on historical comparison, Equinox Group concludes that Opdivo’s clinical performance in this population is worth the price premium. Opdivo will replace docetaxel as the SOC, and should achieve good patient share in NSCLC.

Opdivo in malignant melanoma:

Opdivo was approved as both a monotherapy in later-line melanoma and in combination with Yervoy (ipilimumab) in 1st line melanoma. In the 1st line setting, the Opdivo + Yervoy combination has a strong 14.6% Clinical Innovation score (or percent reduction in unmet medical need), over the combination of Mekinist (trametinib) + Tafinlar (dabrafenib); it offers better efficacy, side effects, mortality, and morbidity. While the Opdivo + Yervoy combination has a disadvantage in dosing and higher drug costs, the superior efficacy of the antibodies is decisive. We therefore expect the Yervoy + Opdivo combination to become the new SOC. Complete data on a Zelboraf (vemurafenib) and cobimetanib combination in 1st line melanoma will be reported soon. When that data becomes publicly available we will update this analysis and post our findings here.

Opdivo in 2nd line renal cell carcinoma (RCC):

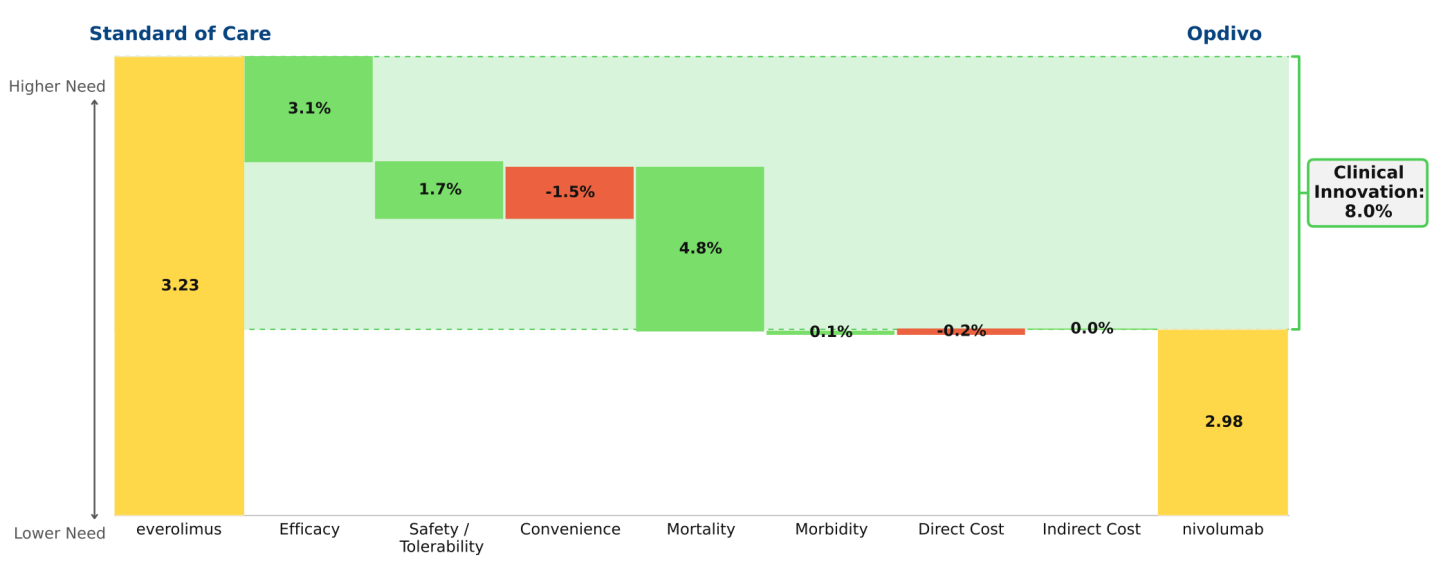

Opdivo has not yet been approved in 2nd line RCC, but we anticipate its approval based on its superior efficacy over the current SOC. Opdivo also has a better side effect profile than Afinitor (everolimus), with its only disadvantages being a less convenient dosing regimen and a slightly higher price. Upon launch, we predict that Opdivo will become the new SOC, and will achieve strong patient share in this population, given its 8.0% Clinical Innovation score.