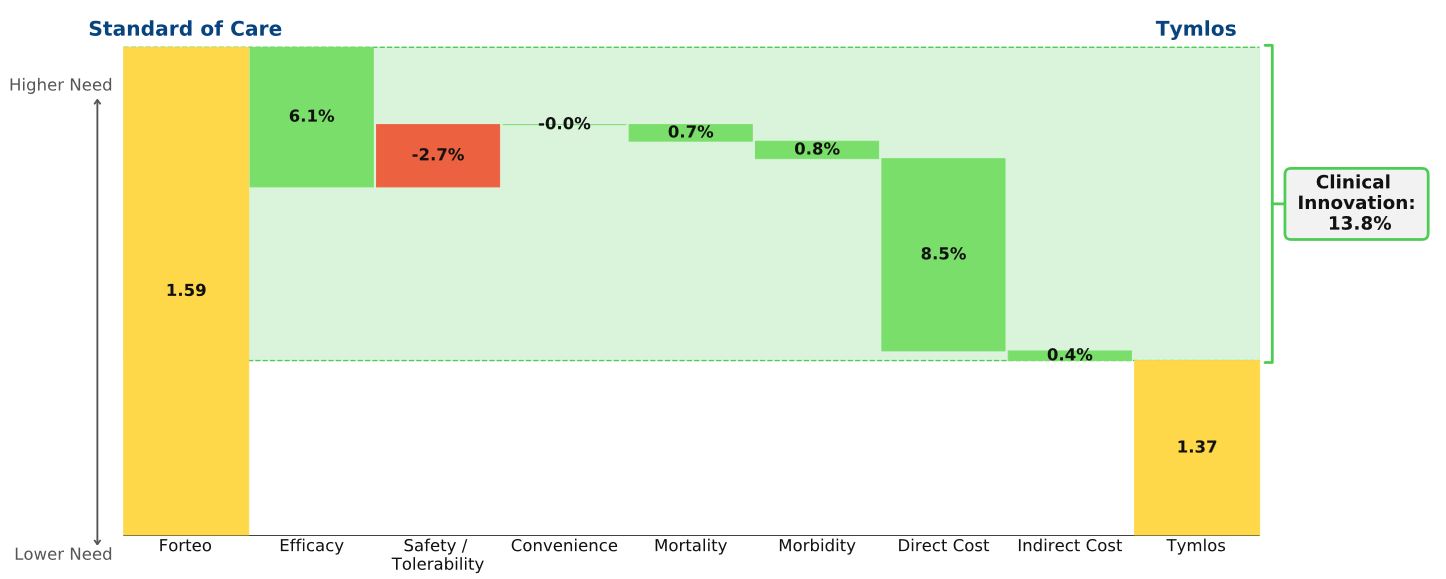

Conclusion: Despite the early success of Radicava, the new ALS treatment provides little clinical innovation. After the buzz surrounding the first new drug for ALS treatment in 22 years passes, we expect patient share to decline. Radicava’s modest efficacy barely improves patient outcomes; our rare diseases model shows that it’s priced too high relative to its clinical benefit.

Strong Start

According to Mitsubishi Tanabe Pharma America, more than 3,500 ALS patients in the US have been treated with Radicava (edaravone), representing around 20% of ALS patients in the US. This patient share is likely driven by excitement from advocacy groups: following Radicava’s approval, ALS Association president and CEO Barbara Newhouse shared her organization’s hope that the approval “signals the beginning of a new chapter” in ALS treatment. Calaneet Balas, an executive VP for the organization, stated there was “a great amount of excitement” surrounding the drug’s approval and that she thinks the new agent “has brought true hope to [the ALS] community.” Disease burden in ALS in extremely high, and the heavy press coverage surrounding the approval propelled a strong first-year of sales: Radicava tallied $110 million in sales in the US alone in the drug’s first full year.

Skepticism

Despite the strong start, we don’t believe Radicava’s growth in the ALS market will be sustained. Radicava is an expensive addition (WAC=$137,400/yr) to riluzole and offers only small efficacy improvements compared to riluzole alone. That modest slowing of disease progression is offset by the inconvenience of near-daily IV infusions in two-week intervals and an absence of data on damage reversal and survival benefits. For Radicava’s price to match the clinical benefit vs. cost of other drugs in rare diseases, its WAC price should be about $55,000/yr.

In addition, although Radicava was approved for all ALS patients, it has only shown results in a small subset of patients who were recently diagnosed (within 2 years) and whose symptoms have rapidly progressed. It is estimated that only 7% of ALS patients meet these criteria, and the authors of the pivotal study state, “There is no indication that edaravone might be effective in a wider population of patients with ALS who do not meet the criteria.”

This limitation has not been lost on payers, with companies such as United Healthcare and Tufts Healthcare requiring patients to meet the trial inclusion criteria in order for their treatment costs to be covered. Lastly, while Radicava boasted strong initial sales figures, we don’t yet have data on rates of treatment discontinuation, which could be high given the modest efficacy, high cost, and inconvenience.

Many doctors share our skepticism. In Discussing edaravone with the ALS patient: an ethical framework from a U.S. perspective, Yeo & Simmons argue that physicians should see past the excitement from advocacy groups. In line with our analysis, these authors urge physicians to take the time to understand the costs and impact of administration demands on patients’ quality of life, and weigh them against the modest efficacy seen in trials.

Our prediction has already started to come true. Mitsubishi Tanabe expects Radicava sales to decline in 2019. In line with our analysis, Mitsubishi expects the inconvenience of frequent infusions to be a deterrent for patients, and the company is already trialing an oral suspension formulation of Radicava that would help justify its current price.