Conclusion: Imbruvica (ibrutinib) delivers profound improvements in efficacy and outcomes in first-line chronic lymphocytic leukemia (CLL); as a result it virtually eliminates the opportunity for developmental agents to offer significant Clinical Innovation in this indication.

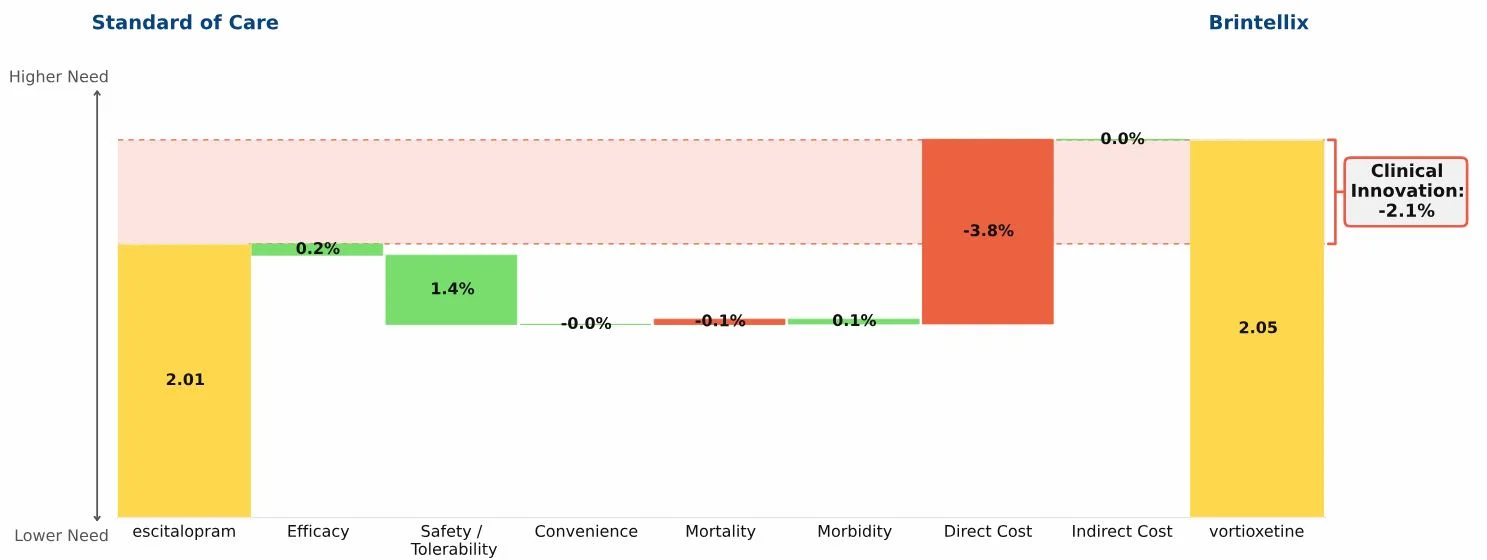

The key data supporting the March 2016 label expansion granted to Imbruvica (ibrutinib) for the first-line treatment of chronic lymphocytic leukemia (CLL) are dramatic: 98% progression-free survival at 18 months and 90% survival at 24 months (RESONATE-2 trial). Regardless of the standard of care to which we compare Imbruvica, it represents dramatic innovation, changing a feared malignancy into a mostly manageable chronic disease, much as Gleevec (imatinib) did in chronic myelogenous leukemia (CML) more than a decade ago. The waterfall chart compares Imbruvica to chlorambucil, reflecting RESONATE-2 data.

The implications for companies developing drugs targeted at CLL are profound:

It will be virtually impossible to deliver significant Clinical Innovation beyond what Imbruvica appears to offer; the only remaining significant unmet need targets are safety/tolerability and cost (see schema figure below).

It will become difficult to recruit first-line patients for clinical trials when as attractive a treatment option as Imbruvica is available, and the trial duration needed to show equivalence to Imbruvica begins to look onerous in relation to the opportunity.

At the same time, relapsed/refractory CLL becomes a much less attractive commercial target. By pushing out progression from first line for years, Imbruvica will radically reduce the number of treatable patients available at second and third lines during the next 5-10 years.

With CLL joining CML, hepatitis C viral infection, and multiple myeloma as serious diseases that can now be more or less cured with drugs, price will become a more important factor in product selection. Agents no better clinically than Imbruvica in CLL or Harvoni in HCV will need to accept lower prices, whether directly or through contracting, to capture much market share.

Since Imbruvica has reduced unmet medical need so dramatically, companies with competing drugs targeting CLL in Phase II or earlier must rethink their development strategies, redirecting resources to other cancer targets.

This figure shows the domains of medical need in first line CLL. The gold bars reflect how well ibrutinib satisfies need in each domain. The grey area above the gold bar shows the extent of opportunity for improvement for developmental agents. We derive ibrutinib’s values by transforming clinical data to dimensionless index scores between 0 (no need―e.g., perfect efficacy) and 5 (no satisfaction of need―e.g., no efficacy). The transformation functions are consistent across indications, and domain analyses are built up from detailed sub-analyses.

The interpretation for ibrutinib in CLL is that little opportunity remains for improving efficacy, convenience, mortality, or morbidity. The only remaining opportunity for meaningful improvement is in safety/tolerability. The high level of need in the cost domain is driven by high drug cost (which is warranted, given the magnitude of clinical benefit).