Food allergies affect 5-10% of the American population. Their prevalence continues to increase, with significant quality-of-life impairments for patients and their families[1]. It is a unique indication in that patients are not chronically ill, but acute illness can occur within minutes even with proper precautions. Death is extremely rare[2]. For decades, the space has seen little in the way of treatment, with the cornerstone of management being strict allergen avoidance. Oral immunotherapy is an option to desensitize patients to their allergens, but it is burdensome and carries risk of allergic reactions and high discontinuation rates[3]. Xolair (omalizumab, anti-IgE antibody, Genentech/Novartis) offers high clinical benefit, safely increasing the amount of allergen that patients can tolerate without experiencing symptoms of severe allergic reactions that can occur through accidental exposure.

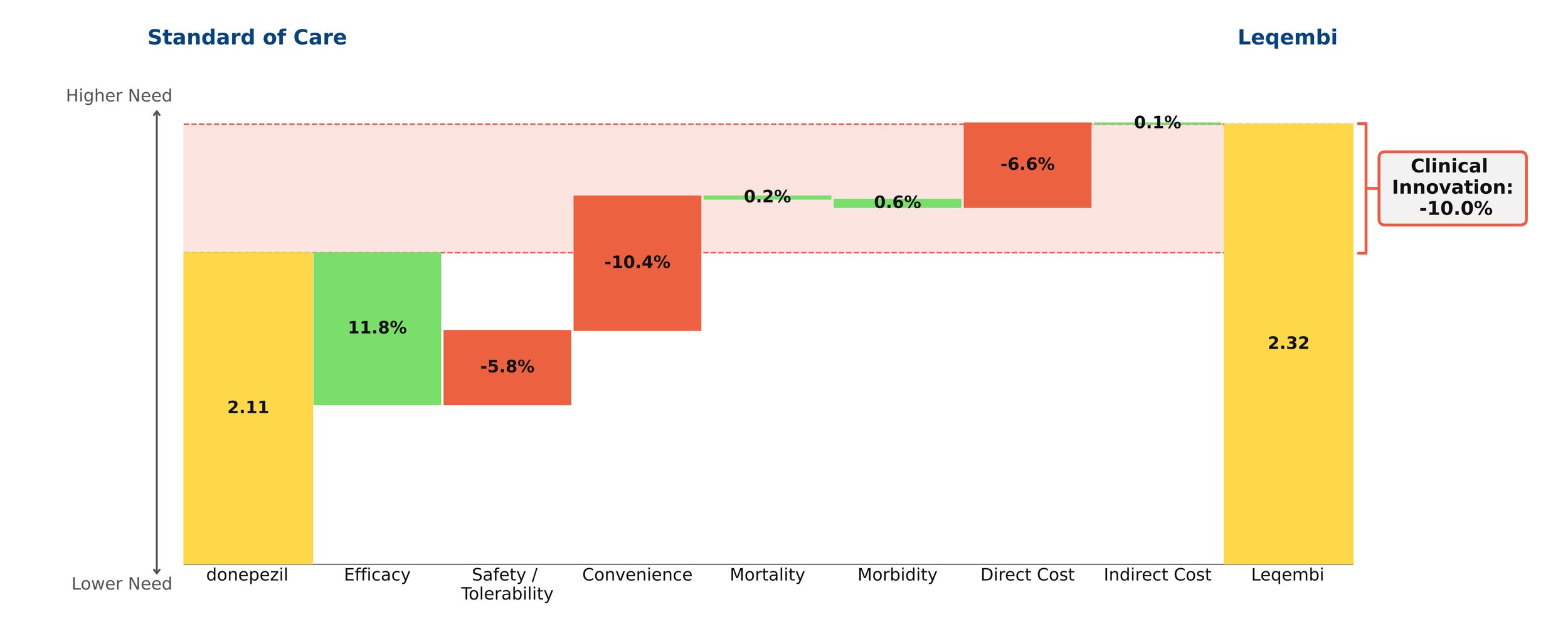

Xolair is incredibly efficacious in this indication, with modest safety/tolerability and convenience drawbacks. Even though it comes with a black box warning for anaphylaxis, safety is a minor concern in practice- it boasts a mild side effect profile and its safety is well established, as it has been on the market for more than 20 years in other indications.

Xolair also confers benefit in common comorbid allergic conditions, such as rhinitis, asthma, and eczema. Xolair comes as a metered-dose autoinjector or prefilled syringe that can be administered at home approximately every other week or every four weeks, depending on baseline IgE levels and body weight, and must be administered indefinitely for continued benefit. Typically, drugs with clinical innovation of 5% or more go on to achieve reasonably strong patient share. Xolair in this indication has very high clinical benefits, but at a steep price of around $100,000 a year. We anticipate strong interest from patients and physicians, but strong push-back from payers.

Xolair will likely become a candidate for biosimilar development when it goes off patent within the next few years, which will likely mitigate the high price and expand access in this poorly served indication.

[1] https://www.cdc.gov/nchs/pressroom/nchs_press_releases/2022/20220126.htm