Conclusion: Monjuvi achieves an impressive clinical benefit for its substantial efficacy improvements over Polivy (polatuzumab vedotin) + bendamustine + rituximab for adults with R/R DLBCL who have failed one or more prior lines of treatment, but favorable market access may be linked to the availability of generic lenalidomide, which remains a question

Monjuvi (tafasitamab-cxix, MorphoSys and Incyte) was approved in August 2020 in combination with Revlimid (lenalidomide) for relapsed or refractory diffuse large B-cell lymphoma (DLBCL) patients. Though the populations enrolled in the Monjuvi and Polivy trials were similar, having received between one to three or more prior lines of therapy, Monjuvi was approved with a differentiated second-line label for R/R DLBCL, while Polivy was approved for third-line.

Monjuvi + lenalidomide boasts a significant increase in progression-free survival compared to Polivy + bendamustine + rituximab (12.1 vs.7.5 months), as well as a notable improvement in overall response rate (55% vs. 42%). While survival data is not yet mature, even the most conservative modeled estimate (22.8 vs. 12.4 months) sees Monjuvi offering significant clinical benefit for R/R DLBCL patients eligible for a second or later line of treatment.

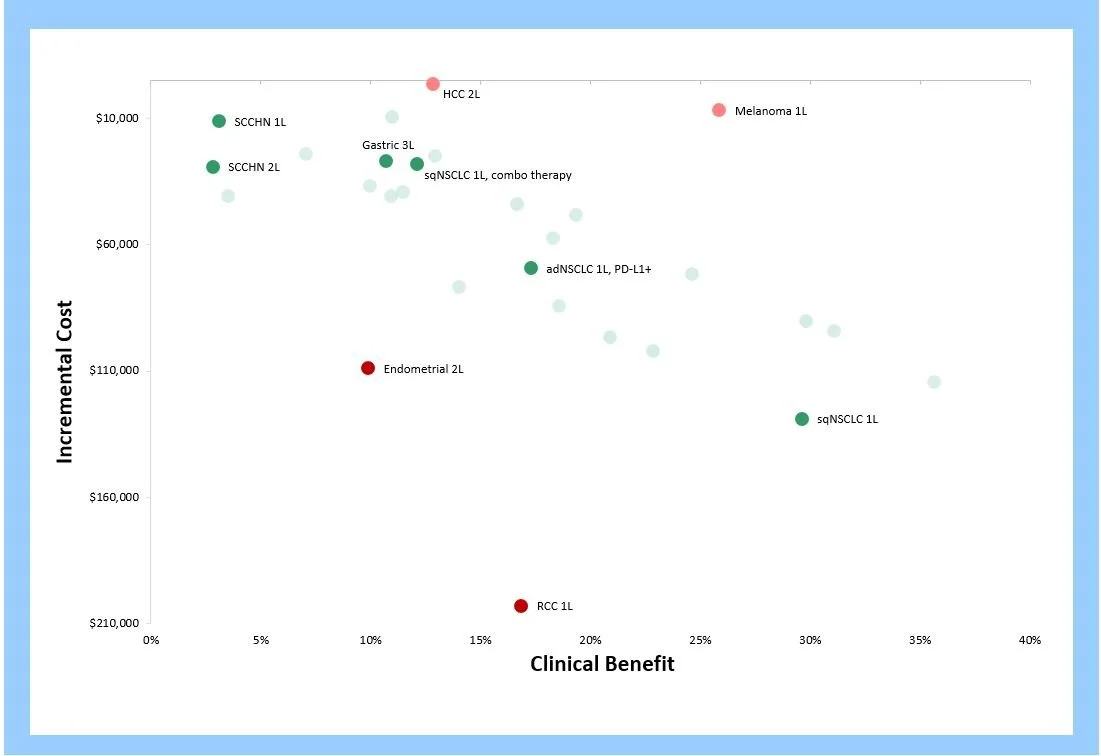

The waterfall chart below shows that Monjuvi offers a significant improvement in efficacy, which produces further benefits in mortality and morbidity, delivering a strong clinical benefit score of 19%.

While offering substantial clinical benefit, this regimen is expensive, exceeding $360,000 annually, assuming Revlimid’s branded price (WAC).

Analysts expect Monjuvi to be a blockbuster, projecting $1 billion sales at peak. We believe Monjuvi’s commercial success hinges on the availability of cost-effective generic lenalidomide (expected to be rolled out in 2022 on a limited volume basis), in the absence of which payer pushback is a near certainty.